Idee

Tra i nostri contenuti trovate gli ultimi

articoli sulla nostra filosofia aziendale

The ERI Code: Guardians of Financial Services Technology Innovation

Alan Goodrich, Regional Sales Manager at ERI, explored in his article how three decades of sustained innovation and a client-centric approach have positioned ERI, and OLYMPIC Banking System, at the forefront of financial services technology in Luxembourg’s evolving and highly regulated market.

Redefining Operating Models: Balancing Efficiency Pressures and Member Growth for Credit Unions

The thought leadership piece “Redefining Operating Models: Balancing Efficiency Pressures and Member Growth for Credit Unions,” examining how real-time capabilities, automation, and core platform modernization can help credit unions overcome operational challenges while placing the member at the center of their transformation strategy.

FiDA – Survival of the Fittest

At this year’s Nordic Fintech Summit edition, Alan Goodrich, Regional Sales Manager at ERI, participated in a “Strategy Talk” session, to examine the impact of the EU Competitiveness and simplification initiatives on FiDA under the banner of “Open Banking: New Opportunities for Unlocking the World of Finance”.

A new chapter for Caribbean Credit Unions

In the Caribbean, credit unions have long served as vital engines of economic empowerment and social inclusion.

How ERI’s Technology Supports High-Performing Investment Strategies

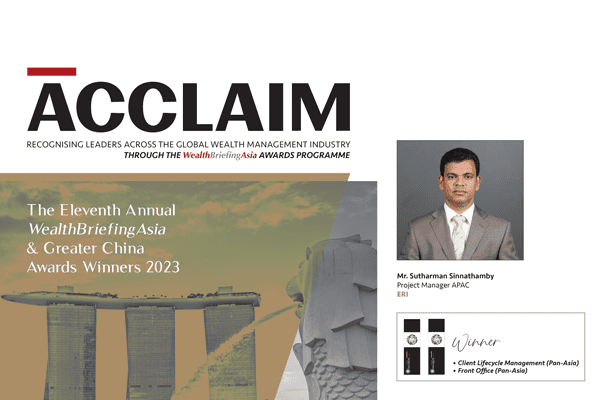

Adam Kasraoui, Sales Manager, ERI, talks to WealthBriefing, explaining how OLYMPIC Banking System’s portfolio management and automated rebalancing drive real-time insights and operational efficiency.

Die digitale Transformation im Bankwesen: OLYMPIC Banking System als Wegbereiter der Zukunft

Inmitten eines rasanten technologischen Wandels steht die Bankenbranche vor einer entscheidenden Wende. Banken müssen auf ein Kernbankensystem vertrauen können, das das Herzstück ihrer täglichen Finanzoperationen bildet

How ERI is staying agile for the next generation of wealth management

According to Jean-Philippe Bersier, Director of Sales and Marketing at ERI, the idea behind the founding of the company was to create an extremely flexible core banking system that would be able to address the requirements of any type of financial institution.

Customer-centricity lies at the core of a digital transformation for wealth managers

According to Alan Goodrich, Regional Sales Manager at ERI, wealth managers must put customer-centricity at the core of their digital transformation in order to achieve the expected returns on investment.

Heart of Stone: Core System Replacement Required

Changing core banking system is likened to carrying out a heart transplant. For a variety of reasons, a core system replacement has become a life-or-death choice for many financial services institutions.

How Compliance and Technology Drive Resilience in Financial Services

Jean-Philippe Bersier, Director of Sales & Marketing, ERI, talks to WealthBriefing, on ERI’s accomplishments this year.

Empowering Credit Unions and Community Banks: Leveraging technology for enhanced member experience and growth.

Credit unions are fast-tracking their digital transformation to meet the increasing demand for remote, online, and real-time services.

Fast and furious: the T+1 transformation of core systems

The securities financial services industry has embarked on a significant transformation with the transition to a T+1 (trade date plus one day) settlement cycle. This shift promises to enhance market efficiency, reduce counterparty risk, and improve liquidity. However, the move to T+1 also presents a series of complex challenges for post-trade participants, particularly in the realm of core systems technology. Yet, in adversity lies opportunity. By addressing these challenges head-on, organisations can not only comply with market demands but also gain a competitive edge, suggests ERI’s Alan Goodrich.

Transforming wealth management in the US: how digital platforms enhance efficiency and client engagement while ensuring compliance

The US banking and particularly the private wealth industry stand at a crossroads, grappling with the dual challenges of meeting escalating demands for efficiency and innovation while adhering to stringent regulatory requirements. This balancing act is exerting unprecedented pressure on financial institutions, compelling them to re-imagine their operational strategies and service models.

Driving Digital Transformation in Banking

Driving Digital Transformation in Banking. In an era of rapid technological advancement, the banking industry finds itself at a critical crossroads. As financial institutions strive to meet evolving customer expectations, comply with stringent regulations, and fend off disruptive competitors, IT transformation has become more than a buzzword – it’s now essential for survival and growth.

The True Total Cost of Ownership of Core Banking Systems

In an era where digital transformation is reshaping the financial services industry, core banking systems are the nerve centre for day-to-day operations. While organisations often prioritise finding the most cost-effective core banking solution, the true TCO often lurks beneath attractive headline prices. Understanding these additional fees and charges is crucial for decision-makers.

Corporate Actions: The next wave of investment?

The financial services industry has been investing heavily in automation and efficiency in the highly visible front-office processes.

Inside Out 2.0 – Has anxiety come to stimulate a post-trade transformation?

The financial industry is undergoing a transformative shift driven by innovations in open banking and financial services, alongside regulatory advancements like the proposed Financial Data Access (FIDA) regulations in the EU, and the global adoption of ISO20022 for SWIFT messages. Technology and efficient operations are inseparable topics and change often creates anxiety. However, embracing the transformation, inside out, is the path to future growth.

Client Experience – Toolkit Report 2024 : What should wealth management firms focus on to deliver a great CX ?

Customer experience – what’s all the fuss about?

Jean-Philippe Bersier, Director of Sales & Marketing at ERI

The Wealth Mosaic Talks To Roger Furrer, Director at ERI, about the best way to approach technology development implementation

In an era defined by rapid technological advancements and evolving customer expectations, the financial services industry finds itself at a critical juncture. Consumers have become used to e-commerce platforms that offer transparent, real-time visibility over the entire payment, execution and delivery life-cycle. Enter the Financial Data Access (FIDA) framework – an evolutionary regulatory proposal that promises to reshape the way financial services providers will expose, access and utilise customer financial data.

How ERI’s OLYMPIC Banking System Has Become A Key Component Of Private Banks’ Growth Strategy

At the core of ERI’s success lies a deep commitment to understanding and addressing the unique needs of our clients. We prioritise customer feedback and work closely with wealth management and private banking professionals to ensure our technology platform, OLYMPIC Banking System, and the suite of solutions it offers, are tailored to their specific requirements.

AUF DIE AUSWAHL KOMMT ES AN – WIE EIN OMNI-OPTI-CHANNEL-ANSATZ ERFAHRUNG UND EFFIZIENZ STEIGERT

In den letzten Jahren wurde viel über Engagement-Kanäle im Private-Banking-Sektor diskutiert. Diese Community war schon immer stark auf persönlichen Service und Beziehungen ausgerichtet. Jahrelang wurde dies von Angesicht zu Angesicht mit E-Mails und direktem Zugang zu dem Kundenbetreuer geleistet. Die Pandemie und die digitalen Möglichkeiten, die durch den Generationswechsel beschleunigt wurden, änderten all das, und die Welt verlagerte sich ins Internet.

How ERI Supports Banks In Future-Proofing Their Operating Model Through Technology

In today’s dynamic landscape, banks and financial institutions must adapt their operating models to ensure sustainable growth and competitiveness amidst a crowded and aggressive market. This includes both traditional and non- traditional players vying for market share and customer attention.

The FIDA framework – an “audentis fortuna iuvat” moment for financial services providers

In an era defined by rapid technological advancements and evolving customer expectations, the financial services industry finds itself at a critical juncture. Consumers have become used to e-commerce platforms that offer transparent, real-time visibility over the entire payment, execution and delivery life-cycle. Enter the Financial Data Access (FIDA) framework – an evolutionary regulatory proposal that promises to reshape the way financial services providers will expose, access and utilise customer financial data.

How ERI supports Wealth Managers in navigating and adapting to a complex compliance framework

ERI’s OLYMPIC Banking System empowers private banks and wealth management firms to modernise their business models, swiftly deliver innovative products, and offer personalised digital services, all while effectively managing costs and risks.

Choice matters – how an omni-opti-channel approach feeds experience and efficiency

Roger Furrer, Director at ERI, outlines the benefits of an omni-opti channel offering.

Tokenisation: Black is the new black

Some clothes designers say that brown is the new black. Being environmentally aware is so fashionable these days that one may say green is the new black. For young people, others say that, politics is the new black. For the securities industry, arguably, tokenisation indicates that black may be the new black. But, asks ERI’s Alan Goodrich, what form does this new black take for market participants, their organisation structures and underlying technology platforms?

Regulation & Compliance: The gift that just keeps on giving

For those operating in the financial services sector, the regulators continue to pile on the pressure with a wave of new challenges in the pipeline to add to those already implemented. Institutions, already struggling with less than optimal legacy technology platforms, must begin to feel like they have become recipients of the proverbial (uninvited) gift that just keeps on giving (but not in a good way). A new, modern, open, integrated core system could be the one item on the wish-list this festive season that would change the narrative and transform the challenges into opportunities.

T+1: Everything, everywhere, all at once

We may not have to deal with inter-dimensional post-trade, just yet. However, a recent Citi Securities Services survey reported that close to 90 percent of respondents expect their local settlement cycles to shorten to T+0 or T+1 within the next five years. In the current T+2 world, once instructions are sent to custodians then, if there is a problem, it will become apparent the next day and may still be corrected and settled in time. In contrast, T+1 actually requires a T+0 approach, underpinned by technology to support continuous real-time processes, as the window for reconciling and settling trades is compressed to same-day. Here, ERI’s Alan Goodrich explores the path to implementing a technology solution that meets the future; everything, everywhere, all at once requirements.

Maximising The Benefits of “As-A-Service” Models

These days we hear a lot about Infrastructure-as-a-Service, Software-as-a-Service, all the way through to Banking-as-a-Service. Unfortunately, there is no one-size-fits-all solution for every institution, is there?

The goal of digital and digital transformation is to retain profitable clients and attract new clients

ERI’s mission is to deliver a unique technology solution, OLYMPIC Banking System, that constantly evolves and adapts to meet the critical requirements of financial institutions and responds to the constraints and challenges of the market. Having successfully delivered more than 400 implementations in over 60 countries, ERI has established deep expertise by continuously envisioning and incorporating future requirements while ensuring the efficiency of the existing product for our clients’ day-to-day use.

ERI’s Unique Tech Solution Fits Banking Trends

ERI constantly adapts its suite of solutions to reflect and respond

to the challenges faced by banks. Diversification of products and

services and reducing time-to-market are key to ensuring new

sources of revenue. Responding to new customer segments and

needs is an enormous challenge. The only way to face it is the capacity

to rely on a digitally enabled platform that facilitates agility

and connectivity thanks to an open architecture. An enhanced and

personalised customer experience will be the backbone of client

acquisition and retention.

How ERI has established itself as a driver of growth for banking and financial institutions

ERI’s mission is to deliver a unique technology solution, OLYMPIC Banking System, that constantly evolves and adapts to meet the critical requirements of financial institutions and responds to the constraints and challenges of the market.

ERI Takes Digital Offering To Next Level

The UK private wealth industry has seen its consolidation trend strengthen in 2022, and 2023 looks to be no different. Banks have been very careful in choosing priority areas for investment. In this respect, technology is now seen as a central element of a bank’s growth strategy, but also as a key differentiator in a highly competitive environment. Leveraging technology to optimise operational efficiency and manage costs is essential to building a robust and healthy bank for years to come.

Die Bank der Zukunft – Welche Lösungen gibt es, um die Agilität zu entwickeln, die die Banken brauchen werden?

Das Auftreten neuer Marktteilneh-mer in der Bankenwelt, auch wenn ihr Marktanteil derzeit nur einen winzigen Bruchteil des Finanzsek-tors ausmacht, hat die traditionellen Banken dazu gezwungen, Überle-gungen zu ihrem Geschäftsmodell und zu technologischen Alternativen anzustellen.

Customer centricity – Michelin star or haute cuisine?

Customer centricity has always been a focus for wealth managers. But, as this digital age unfolds and a new generation of customers takes the reins, what customer-centric means is changing. How can modern wealth managers adapt while still achieving profitable growth?

How ERI Supports Wealth Managers In Future-Proofing Business Models

Jean-Philippe Bersier, Director – Business Development, ERI, talks to WealthBriefing, on ERI’s accomplishments this year.

Beyond Priority Banking: how Asian banks are rethinking emerging Affluent client services

Over recent years, the concepts of Priority and Privilege services have become well- established in the minds of consumers. These services, offered by banks, cater to clients in the mid-wealth segment, providing a moderate level of personalisation.

The Key Drivers of a Successful Modern Banking IT Transformation

Digital transformation in the banking sector is essential but comes with significant challenges as institutions navigate an increasingly competitive and fast-paced environment. One of the most complex tasks is simplifying products and policies, often hindered by longstanding bureaucratic processes and regulatory requirements.

DIGITAL BANKING: ACCELERATING FINANCIAL INCLUSION

Over the last decade, Financial inclusion can be characterised as a means to an end. By ensuring access for households and small and medium enterprises to safe, essential financial services, financial inclusion is a key facilitator of inclusive economic growth. Not only does financial inclusion promote regional economic objectives, it is also considered as an enabler for 7 of the 17 sustainable development goals defined by the United Nations Department of Economic and Social Affairs.

CORE BANKING IN THE CONNECTED WORLD

This whitepaper explores emerging core banking trends and how technology innovations are reshaping the industry.

REDUCING OPERATIONAL AND COMPLIANCE RISKS IN ASSET SERVICING THROUGH PROCESS DIGITALISATION AND DATA INTEGRATION

This paper makes the argument that the root cause of these challenges lies in the fragmentation of data from operational processes that are for the most part disjointed, and to overcome this problem, asset servicing firms must look…

TECHNOLOGY INNOVATIONS IN WEALTH MANAGEMENT & PRIVATE BANKING

This whitepaper explores the technologyinnovations in the Wealth Management (WM) and Private Banking (PB) industry, identifies key trends and provides an outlook on the way forward for the industry on digitising processes in Tier 2-3 banks.

CUSTODY SERVICES: A DIGITAL ROADMAP FOR TIER 2-3 BANKS

“The custody services industry is highly concentrated, with intense price competition favouring large players…

DIGITAL BANKING A TIER 2-3 BANK PERSPECTIVE

Over the last few years, the industry has witnessed several events that have accelerated …

CORE BANKING SELECTION CHALLENGES & APPROACHES A TIER 2–3 BANK PERSPECTIVE

The Core Banking System is considered as being the heart of every bank.

WHITE PAPER – SHARPENING THE COMPETITIVE EDGE: A TIER 2 /TIER 3 BANK PERSPECTIVE

The Euro region experienced a positive growth of 2.4% in 2017.

White Paper-Building Transparency with API / Open Banking

Financial institutions have long been accumulating precious data about customers …

BBCI: a digitalisation strategy for a local service

Banque Burundaise de Commerce et d’Investissement (BBCI), established in 1988, is a dynamic retail and investment bank with the ambition of becoming the local market leader, with an international outlook. The bank’s main objective is to be a benchmark in terms of customer service quality as well as for its digital offering. To achieve these objectives, BBCI has focused on acquiring new talent and implementing new technological tools capable of supporting its future growth.

Bankinter Luxembourg, a digital transformation for an enhanced customer experience

Bankinter Luxembourg offers its clients access to the main financial centre of the euro zone, Luxembourg.

The implementation of OLYMPIC Banking System Portfolio Management System

Andbank had been using OLYMPIC Banking System, ERI’s comprehensive core banking system, for many years, and had also successfully and efficiently upgraded it during that time. Andbank turned to ERI as a trusted partner to discuss the potential features of an enhanced portfolio management system.

ERI deploys an end-to-end transaction banking solution at Stern International Bank

IBSi FinTech Journal March 2022 – Stern International Bank is a US “state bank” as defined in Section 3 of the U.S. Federal Deposit Insurance Act …

Cidel – The implementation of the OLYMPIC Banking System for the Cidel group

Cidel Group is a Toronto, Canada-based international financial services group with several subsidiaries…

BFC Bank and the Faster Payments system

BFC Bank, part of the Bahrain-owned BFC Group, was launched in the UK in March 2018.

IBM – Private banking meets the public cloud

ERI enhanced its core banking system to further support a software as a service (SaaS) model…

Case Study – Wyelands Bank – Blue Chip

Wyelands Bank retains technology partner Blue Chip Cloud to underpin its rapid growth, …

FiDA is in, which means legacy systems are out

Perhaps overshadowed by what appear to be bigger and more impactful changes within the industry, the Financial Data Access (FiDA) regulation doesn’t get many headlines – but it really should. Regulators are targeting mid to late 2026 for it to come into force, which does not leave market participants a lot of time to get their ducks in a row. At the PostTrade 360° Nordic 2024 conference, Alan Goodrich of ERI dove into what the regulation could mean for the industry in the session titled “FiDA and the future of financial services”.

Was passiert beim Thema KI im Banking? Wie sieht „Bank“ in der Zukunft aus und welche Chancen haben europäische Banken?

Was passiert beim Thema KI im Banking? Wie sieht „Bank“ in der Zukunft aus und welche Chancen haben europäische Banken? Videointerview Roger Furrer, Direktor, ERI Bancaire

What is currently pushing the need for core transformation in banking forward

Learn about what is currently pushing the need for core transformation in banking forward with Adam Kasraoui, Sales Manager at ERI.

FIDA Unleashed | Beyond Open Banking & Data Privacy

In the ever-evolving landscape of financial services, a significant transformation is underway—the Financial Data Access (FIDA) Regulation. At its core, FIDA is a mandate—a crucial directive carved in digital ink. It urges banks, fintech startups, and financial institutions alike to adapt or risk falling behind. But what exactly does FIDA entail, and how will it reshape the financial industry and the broader business landscape?

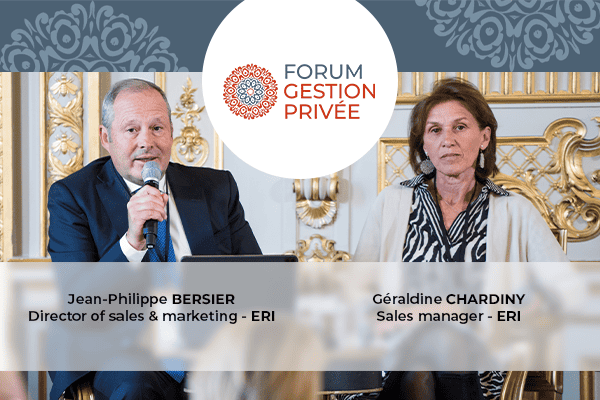

La technologie au service du banquier privé : pour une expérience client optimisée dans un contexte hautement évolutif et réglementé

Géraldine Chardiny, Sales Manager et Jean-Philippe Bersier Directeur des Ventes & Marketing chez ERI nous partagent leur vision et leur retour d'expérience lors de l'atelier qu'ils ont animé au Wealth Tech Morning du Forum de la Gestion Privée. Visionnez le replay au cours duquel ils décryptent les enjeux liés à la transformation digitale des banques privées.

OLYMPIC Banking System empowers digital finance innovation

Alan Goodrich shared invaluable insights into ERI's groundbreaking OLYMPIC Banking System, which is transforming banking systems globally, optimizing operations, and digitizing processes for financial institutions worldwide.

The Connector Podcast – WealthTech Live in Zürich 2024 – Delving into FinTech Innovations and Global Private Banking by ERI

Unlock the world of FinTech innovation with Roger Furrer and Jean-Philippe Bersier from ERI as they share their frontline insights on the OLYMPIC Banking System and more. As key players in the FinTech scene, Roger oversees ERI's operations in the German and Italian-speaking regions of Switzerland, while Jean-Philippe, with his long tenure since 2002, leads sales and marketing from Geneva with a truly global perspective.

Digitalisation, data and the challenges wealth managers and private bankers are currently facing

Check out Alan Goodrich’s interview by Hubfinance at the Wealth Tech Day 2024 and find out more about digitalisation, data and the challenges wealth managers and private bankers are currently facing.

With Dora, operational resilience is getting more attention – from a low level

It was meant to be a broader panel, but few speaker candidates could relate to the topic, and many pros are not yet familiar with the incoming Digital Operational Resilience Act (DORA). Euroclear Finland’s Kati Honkajuuri-Kokkonen and ERI’s Alan Goodrich shared their insights with the audience of PostTrade 360° Helsinki 2023.

CLAB Conference 2023 – Interview, Jean-Philippe Bersier by FIBA Conferences

Jean-Philippe Bersier, Director of Sales Marketing at ERI, shares his inspiring journey and sheds light on ERI's mission to revolutionize banking. Discover how ERI's innovative technologies, like The OLYMPIC Banking System, and its customer-centric approach are shaping the future of banking.

Interview Nad Cyrus – Cidel

Nad Cyrus Vice President IT explains how Cidel has benefited from the implementation of OLYMPIC Banking System in its journey towards digital transformation.

OLYMPIC Banking System, colonne vertébrale du système d’information des banques

Spécialiste du logiciel bancaire depuis plus de 30 ans, ERI développe et distribue un progiciel de gestion bancaire intégré : OLYMPIC Banking System. La fintech promet ainsi de fluidifier les processus opérationnels de ses clients.

Portfolio managers, ESG is now your responsibility

As regulators crack down on greenwashing, asset managers find themselves navigating a tricky new landscape while trying not to trip up. Therese Niklasson – Global Head of Sustainable Investment at Newton Investment Management – sees the industry needing an overhaul of how responsibility is shared and accountability taken. At PostTrade 360° Stockholm, she joined discussion with Sustainalytics’ Benjamin Schofield and ERI’s Alan Goodrich.

Interview Javier Puga – Unblu

Watch the new episode of ERI TALKS: "Conversational Banking puts clients first - loyalty will follow" where Javier Puga, EVP Marketing at Unblu gives us insights on how banks can automate, secure, and simplify their clients’ interactions to best create a meaningful and connected customer experience at each step of their journey.

ESG data could add a new role for CSDs as aggregator

So far, post trade infrastructures have played a humble role in the budding sustainability transition. This Wednesday panel at the PostTrade 360° Helsinki conference dug into whether central securities depositories could play a supportive role as data intermediaries, as reporting requirements stack up both for issuers and investors.

On T+1 settlement, “we are not starting from a blank sheet”

With 27 member nations in the EU, it stands clear that a shortening of the standard settlement cycle by a day can be nowhere near as smooth and quick as in the US, with its single CSD. A panel at the PostTrade 360° Amsterdam conference discussed what could be a path forward.

UK WealthTech Landscape Report Video Interview

As part of the 2022 WealthTech Landscape Report, Anthony Bream, Global Head of Partnerships at The Wealth Mosaic, interviews Paul Driver, Business Development UK at ERI, also known as the solution provider of the Olympic Banking System. In the interview, Paul discusses the current and future goals of ERI, and how they plan to adapt as the industry changes to ensure that they continue to support the growth of their diverse clientele.

Interview Digital Business Africa -Charles Henry NGUEUGA

Charles NGUEUGA, Head of Business development – Africa chez ERI, a expliqué à Digital Business Africa les avantages de la solution OLYMPIC Banking System pour les banques et établissements de microfinance.

Interview Antony SAME – CEO ST DIGITAL

ERI talks to Anthony Samé CEO & Founder of ST DIGITAL about trends in banking technology in Africa.

IBSI – ERI Podcast

How the digital payments landscape is evolving and what’s coming next in PayTech

So is ESG babble, a bubble or a silver bullet?

Sustainability is complex, and as requirements get regulated many questions arise across investment operations.

Fireside interview – Digital music is the blueprint for securities

Faster, cheaper and less risky … the benefits of making securities digital on distributed ledgers makes Deutsche...

Meeting the Rising Tide of Demand and Opportunity in the Middle East

31 Agosto 2021

The state of the private wealth management industry in the GCC will be debated in depth at the August 31 Hubbis Digital Dialogue event...

Custody: The evolution from traditional assets to digital assets

17 Giugno 2021

How to be efficient in this data-driven world ?

10 Giugno 2021

The Great Generational Digital Wealth Transfer – Paper Jam Grand Dossier Private Banking

Private Banking is facing perhaps its greatest challenge. It is estimated that Gen X and Gen Y will inherit €8 trillion from their Baby Boomer...

What makes a successful hybrid ADVISOR model?

11th May 2021

PIMFA Roundtable Discussion

Michael Cahill - Paul Driver

Webinar – A look at the world of Crypto-Assets

11 Marzo 2021

ERI’s Alan Goodrich – with PostTrade 360° Helsinki 2020 from 360° Events

Private Banking is facing perhaps its greatest challenge. It is estimated that Gen X and Gen Y will inherit €8 trillion from their Baby Boomer...

IBS Intelligence – ERI Podcast

CHALLENGES FOR TIER 2 / TIER 3 BANKS:Be flexible and digital ...